Traditional or Roth Contributions? Think It Through for Future You

When deciding between traditional (pre-tax) and Roth contributions, the general rule is to think about whether you are likely to benefit more from a tax break today than you would from a tax break in retirement. Specifically, if you expect to be in a higher tax bracket in retirement, Roth contributions may be more beneficial in the long run.

If your employer-sponsored retirement saving plan allows traditional and/or Roth contributions, which type should you choose? It may help to compare the key features of these accounts and consider a couple of hypothetical examples.

Saving the traditional way

With traditional contributions, the money is deducted from your paycheck before taxes, which helps reduce your taxable income and the amount of taxes you pay now.

Example 1: Maddie earns $3,000 every two weeks before taxes. If she was in the 22% federal tax bracket, she would pay $660 in federal income taxes, reducing her take-home pay to $2,340. On the other hand, if she contributes 10% of her income to the plan on a pre-tax basis — or $300 — she would reduce the amount of her taxable pay to $2,700 and reduce the amount of taxes to $594. After accounting for both federal tax and her contribution, Maddie’s take-home pay would be $2,106. The bottom line? Maddie would invest $300 toward her future but reduce her take-home pay by just $234.

In addition, any earnings made on pre-tax contributions grow on a tax-deferred basis. That means you don’t have to pay taxes on any gains each year. However, those tax benefits won’t go on forever. Any money withdrawn from a tax-deferred account is subject to ordinary income taxes, and if the withdrawal takes place prior to age 59½ (or in some cases, 55 or 50, depending on your plan’s rules), you may be subject to an additional 10% penalty on the total amount of the distribution.

Taking the Roth route

Contributing to an employer-sponsored Roth account offers different benefits. Roth contributions are considered “after-tax,” so you won’t reduce the amount of current income subject to taxes. Earnings grow on a tax-deferred basis inside the account, and qualified distributions down the road will be tax-free (under current tax laws).

A Roth distribution is considered qualified if the account is held for five years and the account owner reaches age 59½, dies, or becomes disabled. (Other exceptions may apply.)

Nonqualified distributions are subject to regular income taxes and a possible 10% penalty tax. However, because Roth contributions are made with after-tax dollars, if at some point you need to take a nonqualified withdrawal from a Roth 401(k), only the portion that represents earnings will be taxable.

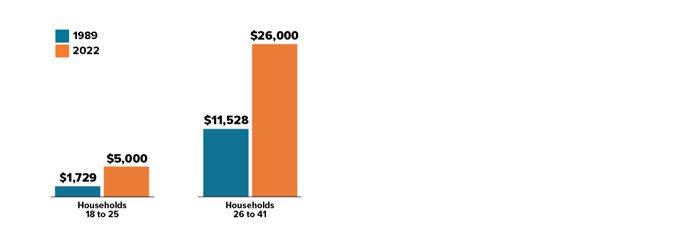

Younger Households Are Getting a Jump on Retirement Savings

Despite heavier student debt burdens and tougher economic conditions, today’s younger workers have more money saved in workplace defined contribution (DC) plans than previous generations had at the same stage of life (adjusted for inflation).

Median DC plan assets, in 2022 U.S. dollars (for households with DC plans)

Source: ICI, 2023

Example 2: When Ryan receives an $8,000 medical bill after a trip to the emergency room, he decides to take a nonqualified hardship distribution from his Roth 401(k) account. Of the $20,000 account balance, $18,400 represents after-tax Roth contributions and $1,600 is investment earnings. Because earnings represent 8% of the total account value ($1,600 ÷ $20,000 = 0.08), this same proportion of Ryan’s $8,000 distribution — or just $640 ($8,000 x 0.08) — will be considered earnings subject to both income taxes and a 10% penalty tax.

Keep in mind that tapping your account before retirement defeats its purpose. If you need money in a pinch, try to exhaust all other possibilities before taking a distribution. The most important benefit of a Roth account is the opportunity to build a nest egg of tax-free income for retirement.

If this still seems like a difficult decision, consider building savings in both traditional and Roth accounts. Doing so would create financial flexibility that might prove useful while you are working and after you retire.